In the fast-paced world of trading, the allure of quick profits can be both enticing and daunting, especially for newcomers stepping into this intricate arena. Simulated trading, often hailed as a haven for novice traders, offers a unique opportunity to practice without the immediate risk of losing real money.

Yet, beneath the surface of this seemingly benign approach lies a spectrum of considerations that can impact one’s journey. Is it truly a risk-free environment? Can it genuinely prepare traders for the unpredictable nature of financial markets? As we delve into the nuances of simulated trading, we will explore its advantages, limitations, and the critical insights every new trader should grasp before diving in.

Benefits of Simulated Trading for New Traders

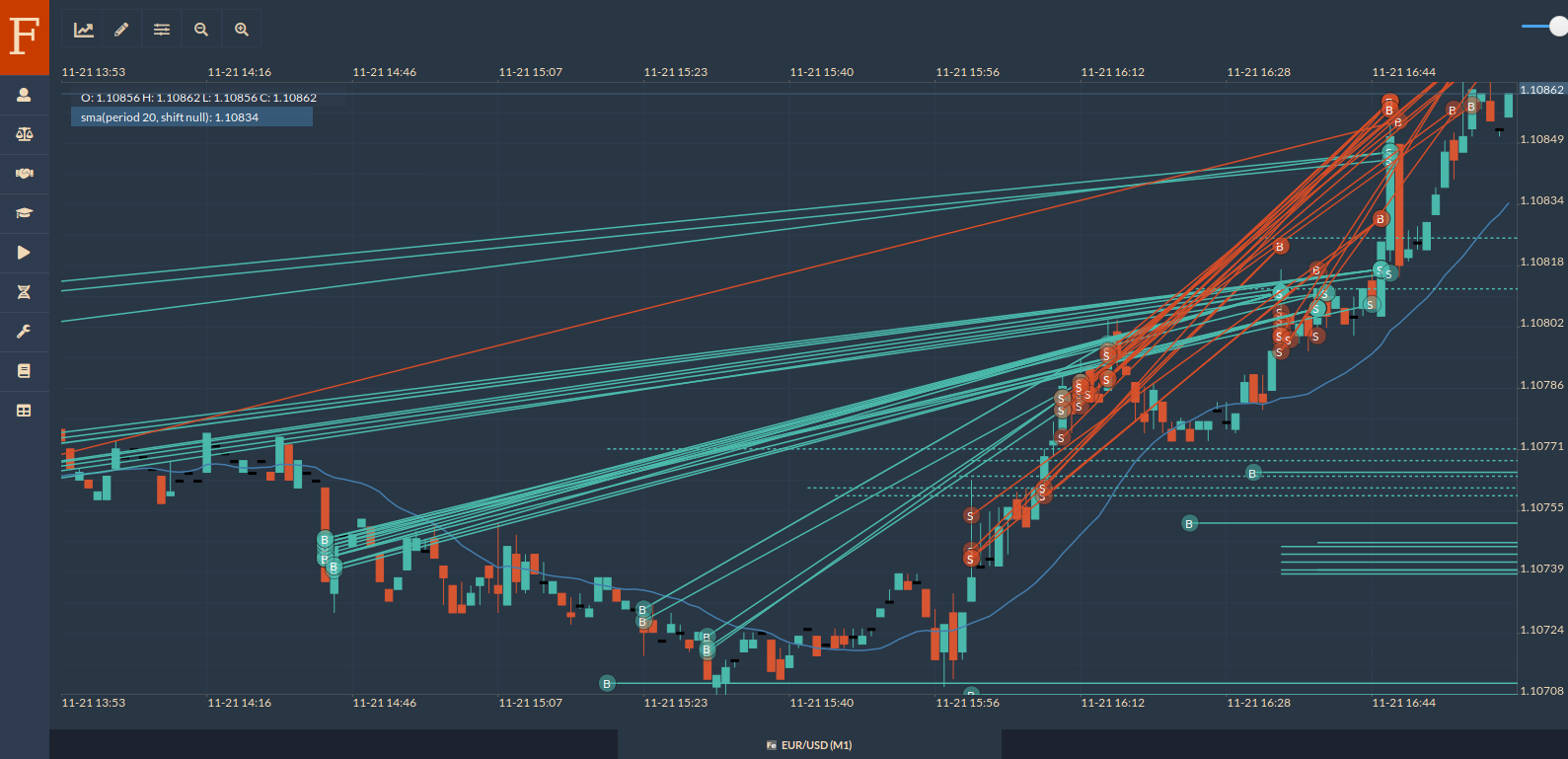

Simulated trading offers a treasure trove of benefits for new traders, acting as a secure sandbox that allows them to explore the complexities of the financial markets without the risk of losing real money. Tools like bar replay free provide an excellent way for traders to analyze historical market movements step-by-step, enabling them to practice decision-making and refine their strategies with precision. Imagine stepping into the shoes of a seasoned trader, making strategic decisions in real time, all while honing analytical skills and cultivating a solid understanding of market dynamics.

New traders can experiment with different trading strategies—trying out everything from day trading to long-term investments—without the financial repercussions that come with actual trading. This immersive experience not only builds confidence as they navigate through the highs and lows of market fluctuations but also allows for the critical practice of risk management techniques in a pressure-free environment.

Ultimately, simulated trading is an invaluable tool, transforming aspiring traders’ uncertainties into knowledge and poise before they ever place a real bet in the market.

Potential Drawbacks of Simulated Trading

While simulated trading offers a haven for new traders to hone their skills, it does come with significant potential drawbacks that merit attention. First and foremost, the artificial environment of a simulation can create a false sense of security.

Traders may become overly confident, believing that their past successes in a risk-free setting will seamlessly translate to real-world markets. Additionally, the absence of emotional stakes in simulated trading—where losses dont impact one\’s finances—can lead to poor decision-making habits. This detachment may instill a misguided view of market behavior, where fear and greed are stripped from the equation.

Furthermore, simulated trading often lacks the complexities of real-life market conditions such as slippage, liquidity issues, and sudden price swings, leaving traders unprepared for the chaos that can arise when real money is on the line. Collectively, these factors underscore the importance of approaching simulated trading as just one step in a larger journey toward becoming a proficient trader.

How Simulated Trading Mirrors Real Market Conditions

Simulated trading serves as a powerful tool for aspiring traders, closely mimicking real market conditions without the financial stakes. It allows new investors to navigate the turbulent waters of market fluctuations—watching prices rise and fall, observing market reactions to the news, and experiencing the emotional rollercoaster that accompanies trading decisions. For instance, when a trader executes a simulated buy order only to see the asset’s value plummet moments later, it can evoke the same rush of panic and uncertainty as a genuine loss would.

Moreover, simulated trading platforms often replicate the speed and dynamics of actual markets, complete with realistic order types and slippage. Yet, despite its realism, simulated trading does not account for the psychological pressures—like fear and greed—that traders face in live environments.

Therefore, while this practice is invaluable for learning and strategy development, it is crucial to remember that the emotional experience of trading with real money is an entirely different beast.

Conclusion

In conclusion, while simulated trading offers a valuable opportunity for new traders to hone their skills and develop their strategies without the pressures of real money on the line, it is essential to approach this practice with a clear understanding of its limitations. The insights gained through virtual trading platforms can significantly enhance atrader’ss confidence and capabilities, yet they cannot fully replicate the emotional and psychological challenges of live trading.

As traders seek to bridge this gap, tools like bareplay-freeee programs can be instrumental in refining techniques and improving decision-making processes. Ultimately, by supplementing simulated trading with ongoing education and a solid risk management strategy, new traders can pave the way for a more informed and successful trading journey.